Refinancing your home loan: As a homeowner, you may be struggling to manage multiple payments and high interest rates on credit card, student, or personal loans. Refinancing your home loan to consolidate debt can simplify your finances, save money on interest payments, and potentially lower your monthly payments. This guide covers the pros, cons, and process of refinancing your home loan to consolidate debt.

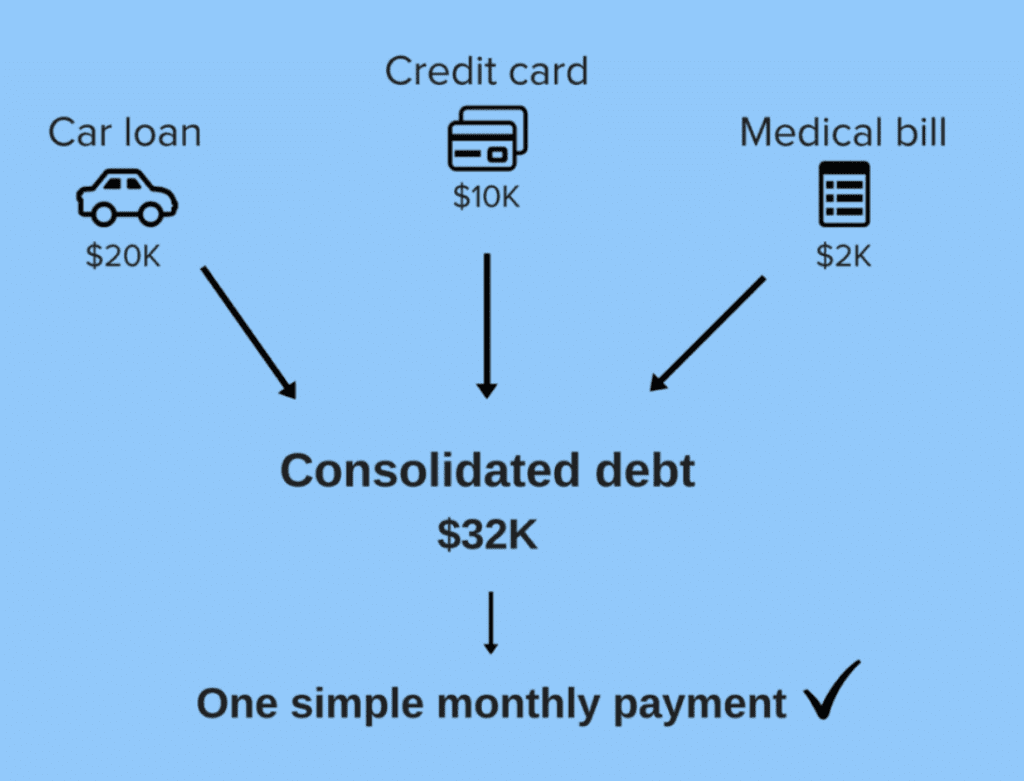

Debt consolidation?

Debt consolidation combines multiple loans into one with a lower interest rate and a single monthly payment. Consolidating your debts can simplify your finances and reduce your interest payments. Refinancing your home loan to consolidate debt involves using your existing equity to pay off high-interest debts and replacing them with a single lower interest rate mortgage payment.

Why Refinance Your Mortgage to Consolidate Debt?

Refinancing your mortgage to consolidate debt has several advantages:

Refinancing your home loan to consolidate debt can lower your interest rate. Mortgage rates are usually lower than credit card, personal loan, and other debt rates, so you may save money on interest payments over the life of your loan.

Simplified Finances: Multiple debts, due dates, minimum payments, and interest rates can be overwhelming. Refinancing your home loan to consolidate debt can help you manage your cash flow and budget by combining multiple debts into one loan with a single monthly payment.

Refinancing to consolidate debt may lower your monthly payments by extending your mortgage repayment term. This can free up monthly cash for other debts or financial goals.

Potential Tax Benefits: Unlike credit card and personal loan interest, mortgage loan interest used to consolidate debt may be tax-deductible. Refinancing your home loan for debt consolidation may require a tax professional’s advice as well as a mortgage broker.

Improved Credit Score: Consolidating and paying off debts with a new mortgage loan may boost your credit score. Because a mortgage loan is a secured loan, having a single, manageable monthly payment may help you make timely payments and lower your debt-to-income ratio, which can improve your credit score over time.

Refinancing Your Mortgage to Consolidate Debt

To make informed decisions, you must understand the steps of refinancing your home loan to consolidate debt. Step-by-step instructions:

Assess your financial situation before refinancing your home loan to consolidate debt. This includes knowing your debt types, interest rates, monthly payments, and total debt. Your credit score will determine your mortgage refinance eligibility.

After understanding your finances, research mortgage lenders to find the best refinancing options. Consider interest rates, fees, customer reviews, and lender reputation. Compare lenders to get the best refinancing terms.

Gather Documents: To refinance a mortgage, you must submit certain documents to the lender. Proof of income, employment, bank statements, credit reports, and debts may be required. To speed up the application process, provide all required documentation.

Calculate Your Equity: Your home’s equity is its market value minus your mortgage balance. Debt consolidation refinances usually require home equity. If you don’t meet the lender’s equity requirements, consider paying down your mortgage or increasing your home’s value.

Apply for a Mortgage Refinance: After gathering all the documents and calculating your equity, you can apply for a mortgage refinance with your prefered lender. The lender will evaluate your application, credit score, and financial documents to determine refinance eligibility. A loan estimate will include the loan amount, interest rate, fees, and closing costs if approved.

Review Loan Terms: Review the lender’s loan terms, including interest rate, repayment term, monthly payment, and fees or closing costs. Before refinancing, read the terms and ask questions. Check the new loan terms against your financial goals and budget.

Complete the Closing Process: If you decide to refinance your mortgage, you must sign the loan documents and pay any closing costs. To ensure you understand the new loan’s terms, read and understand all documents before signing.

Refinance to Pay Debts: You’ll get the refinance proceeds. Pay off credit card, personal, and student loans with these funds. To pay off debts properly, follow the lender’s instructions.

After your mortgage refinance loan has settled, closely monitor your monthly expenses. It is imperative that you stay disciplined and pay your new mortgage and other debts on time.

Make a budget: Have a financial plan to manage your money and pay off debt responsibly.

Seek Professional Advice: Refinancing your home loan to consolidate debt can be complicated. Consult a financial advisor, mortgage broker, or credit counsellor to fully understand the implications of refinancing your home loan and make informed decisions based on your financial situation.

Conclusion:

Refinancing your mortgage to consolidate debt can simplify your finances, reduce your stress level, save you money, and reduce your monthly payments. Before refinancing, it is essential to appraise your financial situation thoroughly. This entails assessing your income, debts, credit score, property equity, and financial objectives.

At Soren Financial, we can assist you in researching mortgage lenders, compiling the required paperwork, and analysing loan terms. Additionally, it is essential to consult a financial advisor, mortgage broker, or credit counsellor if you feel that the monthly repayments are causing you undue stress and have become unmanageable.

Mortgage refinance debt consolidation has numerous benefits, including the consolidation of multiple debts into one monthly payment, the simplification of debt management, and the possibility of a reduced interest rate. However, there are also disadvantages, such as fees and closing costs, and extending the term of your mortgage repayment could increase your interest payments.

Review the loan terms thoroughly to comprehend the financial impact of a mortgage refinance for debt consolidation. This includes being aware of the interest rate, repayment period, fees, and closing costs.

Soren Financial can assist you in reviewing the terms and answering any concerns you may have after approval.

After consolidating your debts, it is essential to monitor your finances and create a budget and financial plan in order to manage your finances and make on-time payments on your new mortgage loan and other debts. Consult a professional before refinancing your mortgage to consolidate your debt in order to consider the pros and cons and assess your financial readiness.

Refinancing your home loan to consolidate debt can be a wise financial decision if done carefully and with a firm understanding of finances. Assess your financial preparedness, investigate mortgage lenders, review loan terms, and closely monitor your finances to ensure that this is the best decision. For assistance comparing lenders and navigating the refinancing procedure, contact us at startnow@sorenfinancial.com.