Over the next 24 months, over $500 billion in home loans will have their fixed rates expire and move to a variable rate.

What is a Fixed Rate?

A fixed-rate loan locks in the interest rate for a predetermined length of time, typically between 1 and 5 years. Fixing rates means that your payments won’t change during the fixed period, no matter how the market or variable rates change. They are popular when interest rates rise and in the current environment you should be asking yourself “Should i refinance my mortgage in 2020?”

Why Are Interest Rates Rising?

The current cash rate, which affects the interest rate, is currently 3.10 percent, a three-point increase since May 2022. This is the highest level since 2012. Senior experts forecast that the cash rate will reach 3.85% by the middle of 2023, remain stable for the remainder of the year, and then decrease by the beginning of 2024.

Due to Australia’s high inflation, the Reserve Bank of Australia (RBA) has raised the cash rate for eight months in a row.

What is the impact on my monthly payments?

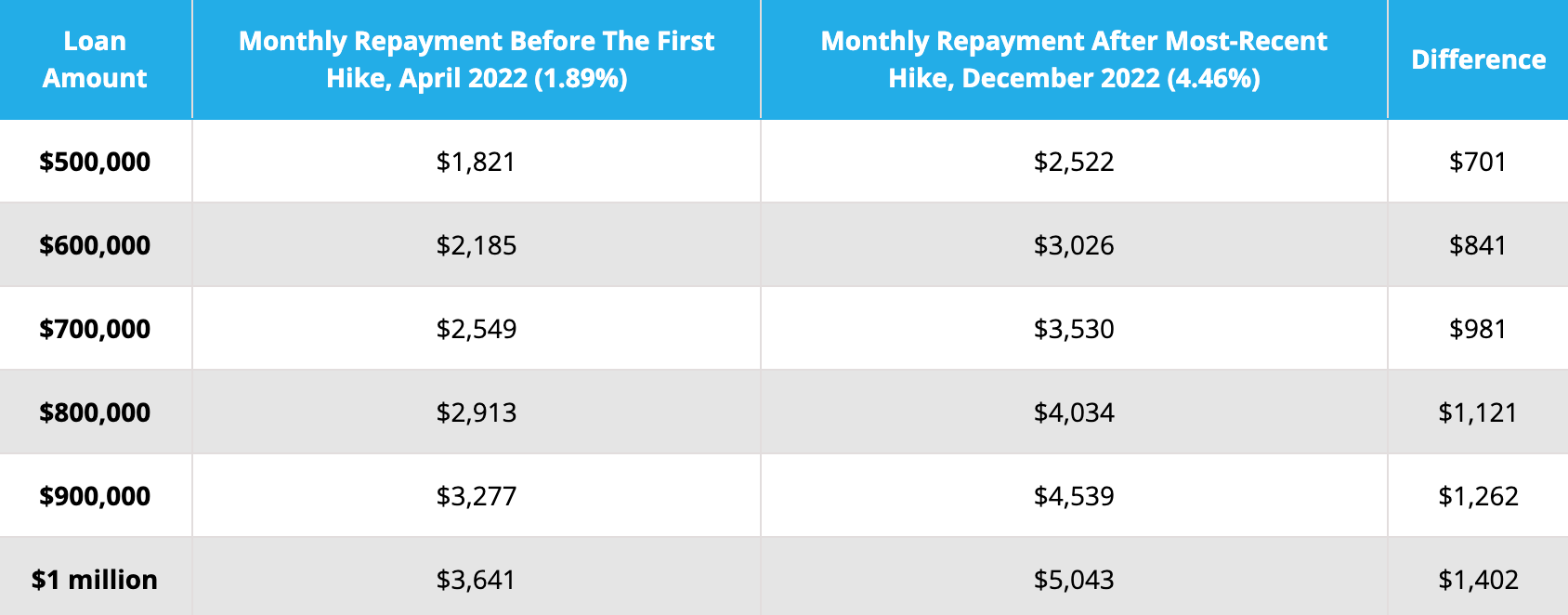

Examine how consecutive increases in the cash rate have raised the monthly payments of borrowers. The chart below compares monthly payments before and after the most recent rate increase in December 2022.

(These sample loan repayments were calculated using our repayment calculator using the lowest variable rate we could give for a 30-year term as of December 2022. (After this date, prices are subject to change.)

Note: The 4.46 percent rate is based on the lowest rate offered by our panel of lenders as of December 27, 2022.

Should I Refinance My Mortgage and Fix My Home Loan in 2023?

Your home loan objectives and financial circumstances will dictate whether you should convert to a fixed rate. Here are some considerations:

If You Fix Your Interest Rates Immediately

Rate increases will not affect you until the conclusion of your fixed period. Experts expect that there will be other rate hikes in the future and that they will not be reduced until at least early 2024.

Your monthly mortgage payments will change and likely increase assuming you are on the variable rate, this is because a fixed rate is higher at the moment and you need to be aware that fixing may not be financial beneficial or viable.

With predictable monthly payments, budgeting is simplified.

Rate reductions will also have no effect on you:

Before the end of your fixed-rate loan, interest rates may begin to reduce. In this instance, you are forced to stay on the higher rate unless you break your rate which can have costly implications.

You may not have access to options such as extra repayments, redraws, and offsets.

If you refinance or switch back to the variable rate before your fixed period finishes, you will incur substantial break fees.

If you do not refinance or make other adjustments before the end of your fixed-rate period, your lender will convert you to the variable rate with higher rates unless you refinance or make other modifications.

Fixed Rate Home Loan Comparison:

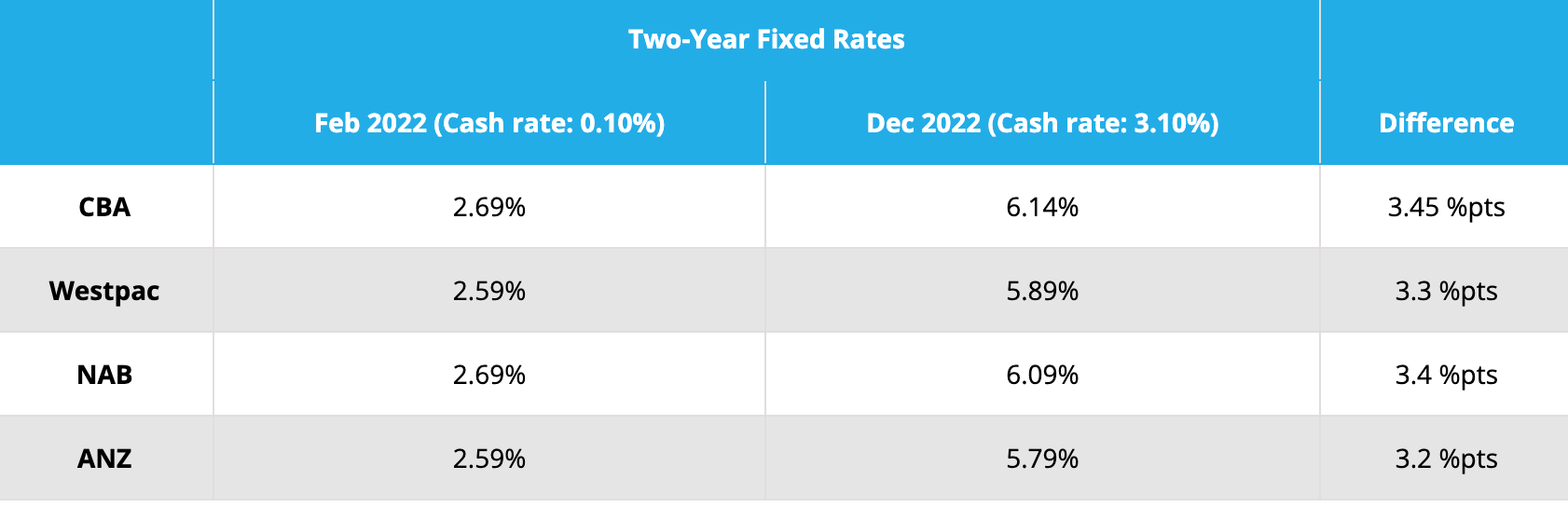

This table displays the cash rate increases over the past year for a two-year fixed mortgage from each of the four largest banks:

NB: The displayed rates reflect principle and interest payments. Current as of December 28, 2022, and subject to change.

In less than a year, the fixed interest rates have jumped by more than three percentage points, the fastest rate of increases since the 1980’s. Interest rates will likely maintain this trend until they reach approximately 7 percent.

Homebuyers must compare their existing variable loan rate to the new available fixed rates to determine if moving to fixed rates is advantageous.

Beginning in 2023, the cash rate is 3.10 percent. These are the projections of leading economists from the four largest banks regarding the future level of interest rates:

ANZ: The cash rate will reach 3.85% by May 2023 after a sequence of monthly increases of 25 basis points.

CommBank predicts that the cash rate will reach a maximum of 3.25 percent in February 2023, at which point the variable home loan rate may plateau.

NAB: The cash rate will peak at 3.60 percent in March 2023, remain constant for the remainder of the year, and then decrease by March 2024.

Westpac: The cash rate will increase to 3.85 percent by 2023 and may drop by 2024.

How high will the variable rate go, should I fix my home loan?

No one has a crystal ball, however detailed market forecasts indicate that interest rates will peak in the middle of 2023 and begin to decline in the beginning of 2024. Assuming banks pass on all rate increases, the ceiling for fixed rates on a home loan is anticipated to be roughly 7%.

The rate of interest rate increases on a home loan during the past year indicates that they have not yet hit their apex. Borrowers who believe a fixed rate may be a suitable alternative for them may want to examine terms of less than two years.

So should I fix my home loan variable rate home loan?

If you did decide to fix your home loan, this would allow them to avoid rate increases in 2023 and take advantage of predicted rate decreases once their fixed-rate period expires.

However you are committing to higher monthly repayments immediately.

If you lock in a rate for more than two years on your home loan, variable rates could fall before the conclusion of their fixed-rate term, increasing the likelihood that they will be stuck paying a higher rate with costly exit fees.

Fixing appears less prudent at this time for investors interested in long-term returns. Fixed rate home loans are relatively high at the moment, and it is anticipated that the cash rate will soon hit its peak so you may have missed the point where there is any financial benefit to you.

If borrowers can make the payments until the cash rate reaches approximately 4%, they may be better off sticking with variable rates for the time being.

If you keep your variable loan benefits, you can save money on interest and payments if interest rates begin to decline sooner than anticipated.

You can refinance with minimal or no early termination costs and minimise your monthly payments.

You are more likely to be able to make additional payments and have access to additional services, such as offset options which are a common addition to a variable rate loan.

Here are the risks to be aware of:

Ensure you can react to growing payments if interest rates continue to rise. If not, you may miss payments or perhaps default on your loan.

Considerations that are Important with A Fixed-Rate Mortgage home loan when comparing a variable rate home loan:

Borrowers choose fixed rates on their home loan, mostly because they anticipate future rate hikes and wish to avoid them and the extra repayments it entails.

Since lenders are increasing fixed interest rates in anticipation of variable rates continuing to rise, borrowers must determine whether it is worthwhile to pay a higher monthly payment in exchange for cost certainty, given that lenders are increasing fixed interest rates in anticipation of variable rates continuing to rise.

When a Fixed Interest Rate May Not Be Optimal

The interest rate drops before your fixed rate period ends?

Interest rates are rising but are expected to peak very quickly.

You intend to refinance your mortgage during the fixed-rate period; however, you must incur substantial break fees.

You intend to use the equity in your property to refurbish or construct a new home.

You wish to utilise the additional features of a variable home loan, such as extra repayments, offset accounts, and refinancing, as you intend to sell the house.

Before refinancing a loan, borrowers should keep the following in mind:

The Course Of Fixed Rates:

The pricing of fixed rates is forward-looking. If the market anticipates a decline in interest rates, fixed rates may be less expensive than variable rates. If the market anticipates rate hikes to continue, fixed rates may be higher than variable rates.

Length Of The Fixed-Rate Period:

The majority of individuals chose their fixed-rate term based on their expectations for future interest rates. Shorter fixed-rate terms provide less protection against interest rate increases.

You can negotiate and obtain a better deal with a longer fixed term (over five years), but this will restrict your house loan’s flexibility for a longer period of time. The most common possibilities are three to five years.

Split loan Choice:

You can obtain a split rate home loan where you have two loan accounts. This is where only a portion of your loan has a variable portion and the remainder has a fixed portion. You can split which ever way you like.

This enables you to make additional mortgage repayments on your variable amount and pay off your debt faster without incurring penalty fees.

Break Fees:

Consider carefully if the advantages of switching to fixed rates outweigh the disadvantages.

If you wish to stop your fixed term early and return to a variable interest rate, you will be required to pay steep departure or break penalties.

Reverse Ratio:

After your fixed term period expires, your loan reverts to a variable interest rate, which is frequently significantly higher than the rate you were paying before to reverting to a fixed loan.

Explore Additional Features:

Determine if your lender offers extra options for a fixed loan. Extra payments, split loans, redraw facility, and an offset account are all advantageous. Fixed home loans with an offset account are rare but there is a small number of lenders who offer them.

Speak to your mortgage broker to see what is best for your needs.