There are some big stamp duty changes for first home buyers. The New South Wales government has unveiled a new plan that will allow an Australian citizen or permanent resident first-time home buyer to pay a substantially lower annual land tax instead of stamp duty on residential property transactions worth up to $1.5 million.

How much stamp duty does a home buyer have to pay?

Traditionally, a first-time home buyer would pay stamp duty up front, which is a hefty expenditure of approximately 2-4% of the purchase price (depending on which state you are in).

According to the NSW stamp duty calculator, stamp duty on a 1.2 million dollar property in Sydney will cost you roughly $50,000, which is certainly a hefty outlay, especially for first-time home buyers.

So, when do these stamp duty reductions go into effect?

Stamp duty exemption already exists as of January 20, 2023. This is intended to make it easier for consumers to enter the housing market and to reduce the financial burden of purchasing a home.

How does stamp duty work now?

Under the existing system, qualifying first-home purchasers in New South Wales who are Australian citizens or permanent residents must pay stamp duty on houses worth more than $800,000.

This can add tens of thousands of dollars to the cost of purchasing a home, making entry into the property market difficult for many people. The new system tries to address this issue by allowing house buyers to pay a land tax rather than stamp duty. You can check out our stamp duty calculator here.

What happens to first-time purchasers who bought a house and paid stamp duty last year?

Stamp duty will be refunded to first-time purchasers who purchased property within the last two months and now want to participate in the NSW government’s annual property tax plan.

When was this legislation enacted in parliament? Is this finalised?

The Act was approved by the parliament the previous year and applies to people who entered the market on November 11, as well as those who did not.

How many people owe stamp duty on acquisitions made last year?

According to Revenue NSW projections, around 2,500 people will request a retroactive refund of the stamp duty they have already paid and instead prefer to pay an annual property tax.

So, how does the land tax operate and how much does it cost?

The land tax will be levied annually by the NSW government and will be based on the value of the property. The government has yet to reveal the full terms of the land tax, such as the rate and any exemptions.

A homeowner will pay $4,000 per year in addition to 0.3 percent of the land’s value.

Is it better for me to pay stamp duty or property tax?

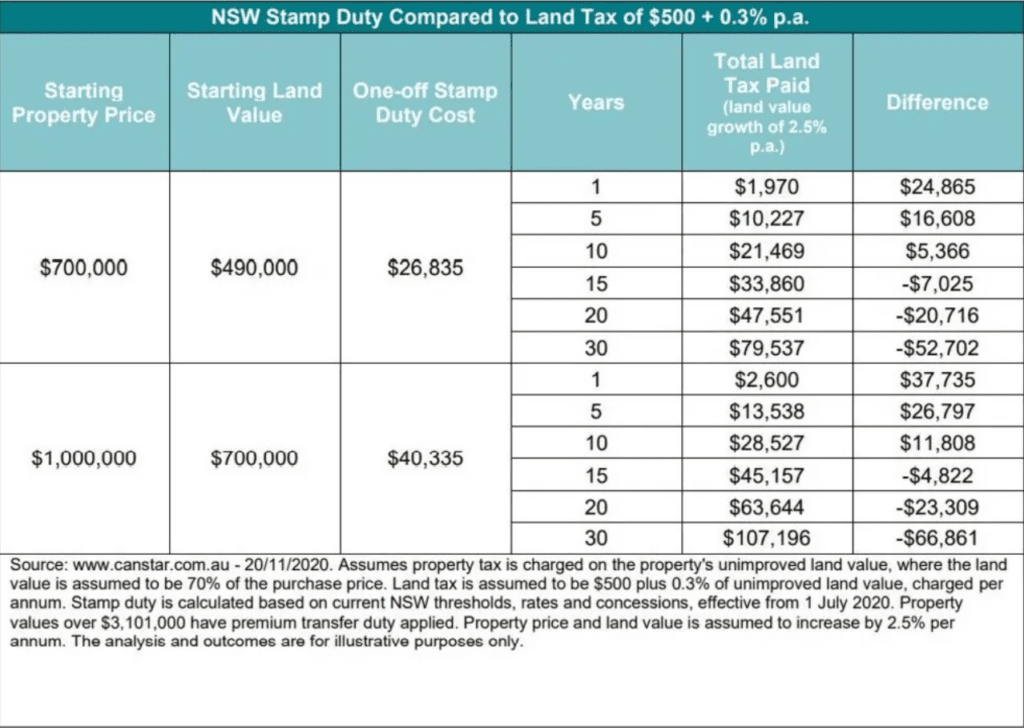

It is dependent on how long you intend to retain the property (as per the Canstar table below). In the scenario below, after more than 12 years of ownership, you would have been better off paying the stamp duty upfront.

Other considerations that may be considered include:

Cash flow: You can use the stamp duty dollars you set up to purchase a better property.

Investment: You may choose to convert this property into an investment later in life, which has tax benefits.

What was the government’s reaction to the stamp duty exemptions?

The Premier, Dominic Perrottet, has long lobbied for this move to be made.

According to what he said, “This national first will significantly decrease upfront costs, shorten the time required to save for a deposit, and result in the great majority of first-time homebuyers paying less tax overall.

“The New South Wales Labor Party is opposed to the reform and has declared that if they win the March election, they will cancel the programme.

What is the opposition’s stance? Will they continue with this policy if elected?

Last week, the opposition released their counter-policy, which included the promise to eliminate stamp duty on properties worth up to $800,000 and to provide a lower rate on residences worth up to $1 million.

The opposition claims that it would cost the government $722 million over a four-year period, which is roughly the same as the cost of the current scheme.

First-time house buyers in New South Wales are excused from paying stamp duty on properties worth up to $650,000.

What changes have been made to the First Home Owner Grant?

In addition, the NSW government stated that the First Home Buyers Grant will be increased from $10,000 to $25,000 for new homes worth up to $800,000, and from $15,000 to $25,000 for new homes valued between $800,000 and $1.5 million.

This will provide further financial aid to first-time home buyers and make it easier for people to enter the housing market.

How is the market responding to these shifts? Let’s start with the good.

First-time purchasers, who have been unable to enter the housing market due to the high cost of stamp duty, will welcome the new plan.

It has been welcomed by the property industry, which has long advocated for a cut in stamp duty.

The property industry has maintained that high stamp duty rates deter consumers from purchasing property, raising the barrier to entry.

What are the critics and detractors saying?

Critics of the new program believe that, while the annual property tax may make it easier for certain people to enter the property market, it will not solve the underlying issue of high property prices in NSW.

They say that the government should take steps to boost the supply of affordable housing in order to reduce property prices, rather than just imposing a property tax to replace stamp duty.

Regardless, the NSW government’s decision to replace stamp duty with a property tax is a significant step forwards for first-time home buyers and will make it easier for people to enter the property market.

Summary:

Finally, the NSW government’s recent announcement that home buyers will be able to choose an annual property tax instead of stamp duty on properties valued up to $1.5 million will make it more affordable for first-time buyers to enter the property market and will help to reduce the financial burden of paying for this transfer duty required when purchasing a home for young Australians.

This is a favorable development for first-time home buyers and the property market in general. More action, however, is required to address the underlying issue of excessive housing prices in NSW. .

Contact us at startnow@sorenfinancial.com for more information