The property market update: As someone who has been invested in the property market since 2003, I must emphasise that Australia is currently facing a significant housing supply shortage and there is no quick fix. This will have huge implications for many across the board as well as property investors in the real estate market. Despite affordability pressures and recent interest rate rises leading to some stabilisation and even reduction in property prices, the country is actually heading towards a “housing supply crunch” in the very near future. As witnessed during the COVID-19 pandemic, when housing demand exceeds supply, (like most markets) property prices tend to rise, which can impact property investors in various ways.

The Housing Supply Issue and the contributing factors

There are several factors contributing to the housing supply issue in Australia, which are important considerations for property investors. One of the key factors is the impact of COVID-19 on construction and approvals. Construction and council delays during the pandemic have significantly slowed down the supply of properties in the market.

Many construction projects have gained approval but are facing challenges in actual delivery due to labor shortages and supply chain issues. The worldwide labor shortage has impacted builders and developers, making it difficult for them to complete projects on time. Additionally, the availability of materials like steel and timber has reduced, further exacerbating delays. Councils have also been slow in approving projects due to their own labor challenges and internal issues, which can impact the supply of housing in the market.

The property market update and the Impact of COVID-19 on Construction and Approvals

The impact of COVID-19 on construction and approvals can have a significant ripple effect on the real estate market and property investors. Recent data from the NSW Department of Planning and Environment’s (DPE) reveals concerning trends in housing activity and supply from July 2021 to June 2022.

There have been 24,641 completions, which is 28.7% below the previous 5 years’ average, and 36,205 approvals, which is 14.4% below the previous 5 years’ average. The NSW DPE predicts that 151,000 new dwellings are likely to be completed in the next 5 years, under a predicted growth scenario, which is 16% below the previous 5 years’ completions. These numbers highlight the impact of COVID-19 on construction and approvals, leading to a significant slowdown in housing supply, which can impact property investors’ strategies and decisions.

Projected Shortage and Demand for Housing

The projected shortage of housing in Australia, along with the demand for housing, is a critical factor for property investors to consider. By 2024-2025, it is projected that net overseas migration will fully recover to pre-pandemic levels, with approximately 235,000 migrants per year. However, based on these figures and taking into account new building approvals and completions, it is estimated that Australia will face a dwelling shortage of around 163,400 by 2032.

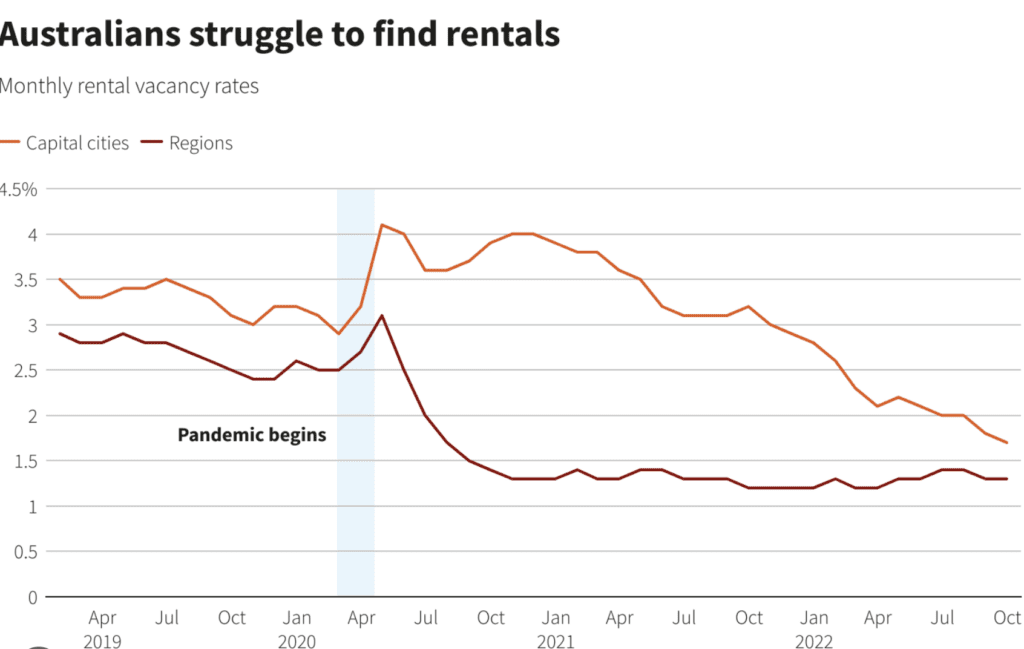

This projected shortage is expected to increase the demand for housing, particularly in cities like Sydney, Brisbane, and Melbourne, where historically, 88% of overseas migrants have moved. This will further intensify the pressure on rental markets, which are already strained due to the lack of new housing supply. Property investors need to be aware of these projections and trends in housing demand and supply to make informed decisions.

Challenges and Opportunities for Property Investors

The housing supply crunch in Australia presents both challenges and opportunities for property

The challenges include increased competition for available properties, rising property prices due to limited supply, and potential impacts on rental yields. Property investors may need to adjust their strategies, such as being prepared to pay higher prices for properties, seeking alternative locations with better supply prospects, or diversifying their investment portfolio to include other types of properties or investment vehicles.

However, there are also opportunities for property investors in this current market scenario. The projected increase in demand for housing, especially in key cities, can potentially lead to higher rental yields and capital appreciation. Property investors can also explore opportunities in affordable housing initiatives, such as government incentives for affordable housing developments, which can provide stable rental income and long-term investment prospects.

Addressing the Housing Supply Crunch in Australia

To address the housing supply crunch in Australia, it is crucial for various stakeholders, including governments, developers, builders, and investors, need to work together. The government can play a role in streamlining the approvals process, addressing labor shortages, and providing incentives for developers to increase housing supply.

Developers and builders can focus on innovative construction methods, exploring off-site manufacturing and other efficient approaches to speed up the construction process. Property investors can also contribute by investing in housing developments and affordable housing initiatives to support increased housing supply.

In conclusion, the housing supply shortage in Australia presents both challenges and opportunities for property investors. Understanding the factors contributing to the issue, monitoring the impact of COVID-19 on construction and approvals, and being aware of the projected shortage and demand for housing can help property investors make informed decisions.

By adapting their strategies and exploring opportunities in affordable housing initiatives, property investors can navigate the current market and potentially benefit from the evolving real estate landscape in Australia. Have a look at our borrowing calculators here to see if you are ready to take the next step in your wealth creation journey or get in touch with us at startnow@sorenfinancial.com.