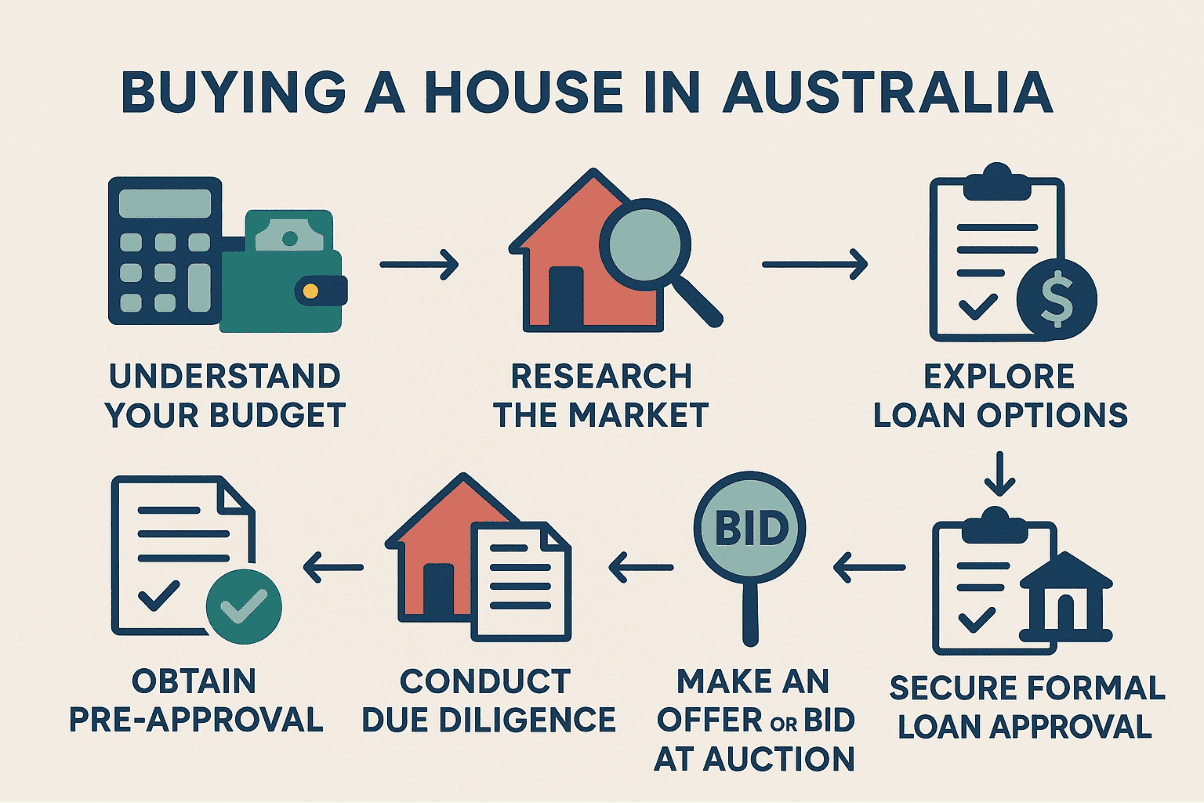

Purchasing Your First Home in Australia: What to Expect at Each Stage

Purchasing your first home in Australia is a milestone that many buyers aspire to achieve. The journey can be both exciting and overwhelming, particularly for those navigating the property market for the first time. By understanding the steps of buying a house and the process of buying a house from beginning to end, you can approach the purchase with more clarity and confidence. This guide explains the main stages involved in the step by step buying a house process, while maintaining a neutral overview of what buyers typically experience.

Understanding Your Budget

The first step in purchasing your first home is assessing your financial position. This stage usually involves looking at income, savings, existing debts, and potential borrowing capacity. Lenders typically review these details to determine how much they are willing to lend, but buyers also benefit from knowing their own limits before searching for properties. Being clear on budget helps narrow down realistic options and prevents wasted time on homes outside your range.

Researching the Market

Once you know your budget, the next step in the process of buying a house is to research the property market. Market research can include reviewing listings online, attending open homes, and looking at recent sales data in the suburbs you are interested in. By comparing different locations and property types, buyers can identify where they may find the best value. This step also helps to understand price trends, auction clearance rates, and demand levels, all of which can influence purchasing decisions.

Exploring Loan Options

Another key stage in purchasing your first home is exploring mortgage options. Different lenders may offer varying rates, features, and loan structures. Buyers often compare factors such as interest types, repayment flexibility, and offset accounts when reviewing loan products. Although professional advice may be helpful at this stage, the focus is on understanding the differences between products so you can choose one that aligns with your personal circumstances.

Obtaining Pre-Approval

Pre-approval is a significant step in the step by step buying a house process. It provides an indication of how much a lender is willing to finance, based on your financial information. Pre-approval is not a guarantee of final approval, but it can give buyers confidence when making offers or bidding at auction. Sellers may also view pre-approved buyers more favourably, as it demonstrates readiness to proceed with the transaction.

Conducting Due Diligence

Due diligence is essential when purchasing your first home. This stage involves reviewing the contract of sale, checking building and pest inspection reports, and clarifying any zoning or planning restrictions on the property. Buyers may also consider reviewing strata records if the property is an apartment. The aim of due diligence is to ensure there are no hidden surprises that could affect the property’s value or livability.

Making an Offer or Bidding at Auction

Once due diligence is complete, the next stage in the process of buying a house is making an offer or preparing for auction. In private sales, buyers typically submit a formal written offer to the seller or their agent. At auction, the property is sold to the highest bidder once the reserve price is met. Understanding the rules of each method and setting a maximum price beforehand can help buyers avoid overcommitting.

Securing Formal Loan Approval

After an offer is accepted or an auction is won, the lender will review the contract and property details before granting formal approval. This is a critical milestone in the step by step buying a house process. At this stage, the lender may arrange a property valuation and request additional documents. Once approval is confirmed, the loan agreement is finalised, and buyers can prepare for settlement.

Settlement Process

Settlement is the final stage of purchasing your first home. It usually occurs several weeks after contracts are exchanged. During this time, the balance of the purchase price is transferred, legal documents are lodged, and ownership is officially transferred to the buyer. Buyers receive the keys once settlement is complete, marking the official end of the home buying journey.

Comparison to Alternatives

Purchasing your first home is not the only pathway to securing accommodation. Renting remains an alternative for many individuals, offering flexibility without the long-term financial commitment of a mortgage. Others may explore rent-to-buy schemes, co-ownership arrangements, or investment in smaller properties before upgrading later. Each option carries its own considerations, such as affordability, lifestyle needs, and future plans, making it important to weigh the differences objectively.

Conclusion

Purchasing your first home in Australia involves a structured series of steps, from setting a budget to completing settlement. While the process of buying a house can feel complex, breaking it down into clear stages makes it more manageable. By focusing on research, preparation, and due diligence, first home buyers can approach the journey with greater confidence and realistic expectations.

If you are considering purchasing your first home and would like support in understanding the step by step buying a house process, talk to us here at Soren Financial. Our team can walk you through the options, answer your questions, and provide the guidance you need to move forward with clarity.

FAQs

- What are the first steps of buying a house in Australia?

The initial steps include assessing your budget, researching the market, and obtaining pre-approval from a lender before making offers on properties. - How long does the process of buying house usually take?

The timeline varies, but most purchases take between six to twelve weeks from signing the contract to settlement, depending on the conditions agreed. - Do I need pre-approval before purchasing your first home?

Pre-approval is not mandatory but is highly recommended, as it helps buyers understand their borrowing power and demonstrates seriousness to sellers. - What is included in due diligence when purchasing your first home?

Due diligence typically involves reviewing the contract of sale, building and pest inspections, strata records if applicable, and verifying zoning regulations. - Can I buy a home without attending an auction?

Yes, many properties are sold through private treaty sales, where buyers submit offers directly to the seller or their agent, instead of competing at auction.