Australia’s Property Market Revival

In recent years, Australia’s property market has undergone a substantial transformation. The downturn experienced in 2022 across multiple housing markets has given way to a robust recovery by the end of 2023, as detailed in the latest report from Domain. This comprehensive analysis explores the resurgence of the market, focusing on key trends, the role of mortgage brokers, and the significance of home loans.

The 2022 Downturn and Subsequent Recovery

The Australian housing market faced significant challenges two years ago, with a noticeable dip in prices and a decline in market confidence due to rising interest rates and inflation. Despite these hurdles, the market has demonstrated remarkable resilience. During this period, the services of mortgage brokers became increasingly crucial. Homeowners and potential buyers sought advice from ‘mortgage brokers near me’ to navigate the fluctuating market conditions effectively.

Domain’s House Price Report: A Catalyst for Change

The House Price Report released by Domain for the December quarter was pivotal in illustrating the recovery trajectory. It provided an all-encompassing view of the housing trends nationwide, signalling a positive turnaround for the Australian property market. This report became a valuable resource for mortgage brokers and financial advisors, offering them insights to better serve their clients, especially in cities like Sydney, where the demand for ‘Sydney mortgage broker’ services saw a notable increase.

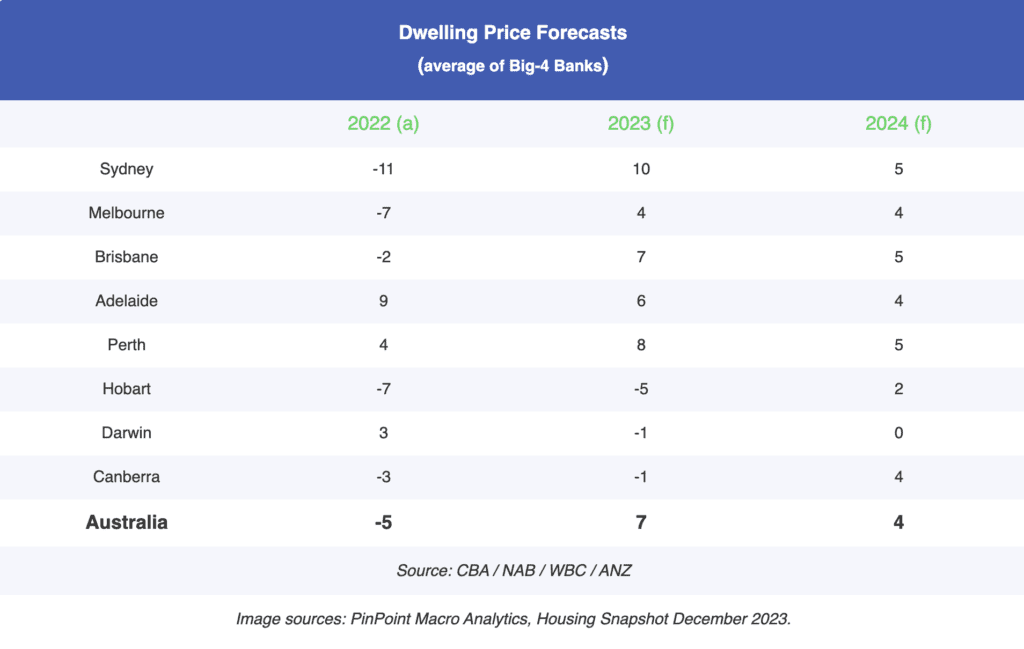

During the final quarter of the year, most of the major cities in Australia witnessed a resurgence in their property markets. However, Melbourne stood as an exception, with projections indicating its full recovery is likely to occur in 2024, as per the report’s findings.

In the forefront of median house price growth in 2023 was Adelaide, showcasing a remarkable 12.7 percent increase from the previous year, outpacing Perth with an 11.9 percent rise and Sydney with a 10.6 percent hike. Contrasting this upward trend, Canberra, Hobart, and Darwin experienced declines in their median house prices by 4.6 percent, 2.5 percent, and 1.2 percent, respectively.

By the end of 2023, Sydney emerged at the forefront with record-setting median house prices, reaching a peak of $1,595,310. This was closely followed by Brisbane at $888,285, Adelaide at $875,034, and Perth at $742,390. Additionally, the unit prices in Canberra, Brisbane, and Adelaide also reached new heights, with figures standing at $625,597, $524,202, and $484,407, respectively.

Dr. Nicola Powell, the Domain Chief of Research and Economics, remarked: “Despite initial expectations of high interest rates, stretched affordability, and cost-of-living pressures capping property prices in 2023, factors such as the shortage of new housing, rising construction costs, an expanding population, and a strained rental market have continued to fuel the demand for housing.”

The 2023 Recovery: A Detailed Overview

The year 2023 marked a significant recovery phase for most Australian capitals, witnessing a rebound in both house and unit prices. Mortgage brokers, particularly in Sydney and Adelaide, found themselves increasingly busy, assisting clients in securing favourable home loans amidst the rising market. The surge in online searches for ‘mortgage brokers near me’ highlighted the growing need for expert local guidance in home loan procurement.

The Surge in demand for Mortgage Brokers near me

As the market recovery gained momentum, there was a notable increase in online searches for ‘mortgage brokers near me’. Homebuyers sought out local experts who could offer personalised advice and assistance in the complex process of securing a home loan. This trend underscores the importance of local knowledge and expertise in the mortgage industry.

Sydney’s Real Estate Boom and the Role of Sydney Mortgage Brokers

Sydney, a key player in the national property market, witnessed a significant boom, with median prices reaching record highs by the end of 2023. This surge led to an increased demand for services from ‘Sydney mortgage brokers’. These professionals played a crucial role in aiding clients to understand the nuances of the Sydney market and in helping them secure competitive home loans.

Adelaide and Perth’s Market Growth: The Impact on The Housing Market

The significant growth observed in Adelaide and Perth contributed to the overall upward trend in the Australian housing market. In these cities, the role of mortgage brokers became increasingly important. They guided buyers and investors to leverage the growth opportunities in these markets, often being referred to as the ‘best mortgage broker’ by their satisfied clients.

The Importance of Choosing the Best Mortgage Broker

In the wake of the market’s recovery, the importance of selecting the ‘best mortgage broker’ has become more pronounced. A proficient broker can significantly influence the loan terms a buyer receives and the overall property purchasing experience. They offer invaluable assistance in navigating the myriad of home loan options available, ensuring clients make well-informed decisions.

The Crucial Role of Home Loans and Mortgage Broker in a Market Recovery

Home loans have been a critical factor in enabling many Australians to purchase property during this recovery phase. Despite challenges like high interest rates and cost-of-living pressures, the strong demand for housing was sustained, in part, due to the availability of home loans with favourable terms.

The Dual Impact of High Interest Rates on Home Loans

High interest rates had a dual impact on the market, simultaneously constraining borrowing capacity and fueling demand in certain market segments. This situation further highlighted the importance of securing the right home loan, where the expertise of mortgage brokers became indispensable.

Future Trends: Predictions for 2024 and Beyond

The outlook for 2024 suggests further changes in the property market. Anticipated interest rate cuts in the latter half of the year could spur increased demand, potentially driving prices higher. Mortgage brokers will need to stay informed of these developments to provide the best advice to their clients, particularly in high-demand areas like Sydney, where the role of a ‘Sydney mortgage broker’ will be crucial.

Addressing Future Challenges: The Pivotal Role of Mortgage Services

The Australian property market may continue to face challenges, including mortgage affordability and broader economic pressures. However, tax cuts and the easing of inflation are expected to offer some relief. Mortgage brokers and home loan providers will be key in helping clients navigate these challenges, with the ‘best mortgage broker’ services being in high demand. In addition, a report released from Oxford Economics Australia outlined that property prices will rise by 2.7 per cent in the combined capitals over the remainder of the 2024 financial year

In-Depth Conclusion: Reflecting on Australia’s Market Recovery and Mortgage Services

The recovery of Australia’s property market from the 2022 downturn has been robust, with several cities achieving record highs. As the market evolves, influenced by various economic factors, the role of mortgage services, including home loans and mortgage brokers, will remain integral. The expertise of ‘Sydney mortgage brokers’ and the search for the ‘best mortgage broker’ will continue to be critical for navigating the dynamic property landscape. Reach out to us today at startnow@sorenfinancial.com and lets discuss your next step.