Unlocking Support: First Time Home Buyer Grants in Australia

Purchasing your first home can be one of the most significant milestones in life, but for many Australians it also comes with financial challenges. To help address affordability, governments offer a range of support programs commonly referred to as first home buyers grants or first time homebuyer grants. These incentives aim to make it easier for individuals and families to enter the property market, particularly when saving for a deposit and covering upfront costs.

What is a First Home Buyers Grant?

The first home buyers grant, often called the first time home buyer grants, is a government initiative designed to assist eligible Australians with the cost of buying or building their first home. The specifics of the scheme differ by state and territory, but the general principle remains consistent: eligible buyers may receive a one-off payment that can be applied towards the purchase price, construction costs, or related expenses. The grant is separate from stamp duty concessions or exemptions, which are another form of support sometimes offered alongside the grant.

How First Time Home Buyer Grants Work

The process of accessing first time home buyer grants usually begins when applying for a home loan. Most lenders can assist with the application by submitting the paperwork to the relevant state or territory government. Once approved, the funds are typically paid at settlement or, in the case of building a new home, during the construction phase. It is important to understand that these grants are not ongoing payments but a one-time benefit intended to reduce initial financial barriers.

Eligibility Requirements for First Time Home buyer Grants

Eligibility for the 1st home buyer grant depends on factors such as residency, property type, and whether you or your spouse have previously owned property in Australia. Generally, applicants must be at least 18 years old, Australian citizens or permanent residents, and intend to live in the property as their principal place of residence. The property usually needs to be newly built or substantially renovated, though some states allow grants for purchasing established homes under specific conditions. Each state has its own rules, thresholds, and maximum property values that can qualify for the grant.

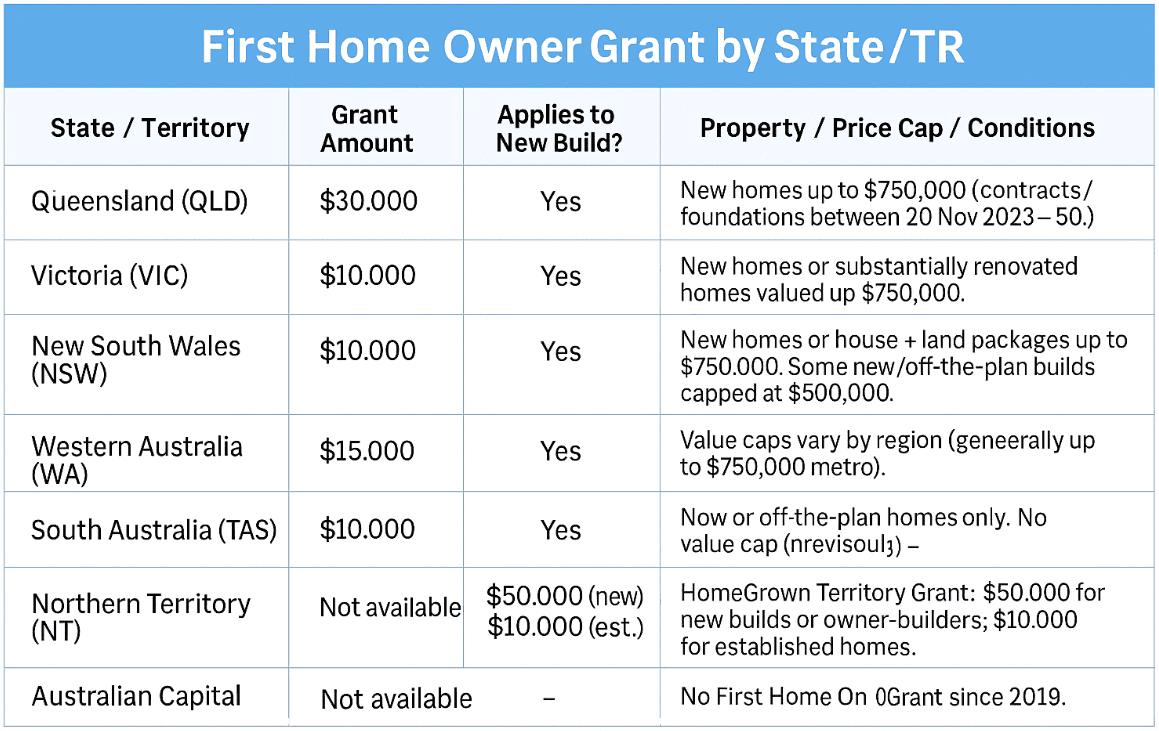

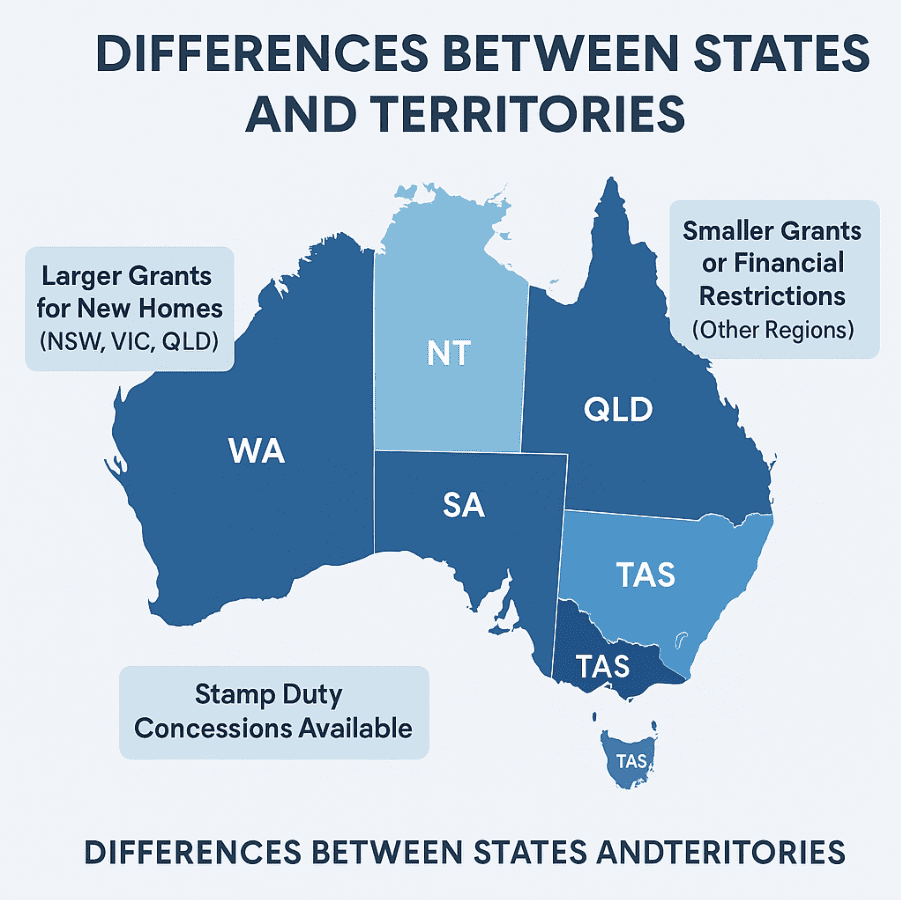

Differences Between States and Territories

Because housing markets vary across Australia, the first home loan grant schemes also differ. For example, New South Wales and Victoria offer larger grants for new builds compared to smaller amounts in other regions. Some states may also provide stamp duty exemptions alongside the first buyers grant, while others restrict grants to properties below certain price caps. These variations mean that researching the specific rules for your state or territory is essential to determine whether you are eligible and how much you might receive.

Benefits of the First Home Loan Grant

For those purchasing your first home, the 1st home loan grant can help bridge the gap between savings and upfront costs. One of the most significant benefits is the reduction in the amount of savings required before entering the property market. This can accelerate the timeline for buying and reduce reliance on other sources of finance. In addition, the grant can sometimes be combined with other incentives, such as stamp duty concessions, providing further relief for first home buyers.

Limitations and Considerations

While the first home buyers grant offers meaningful support, it does come with limitations. The grant amount may not cover a large portion of the overall purchase price, particularly in higher-value markets such as Sydney or Melbourne. In addition, restrictions on property types or maximum value thresholds can exclude certain buyers. Another consideration is that grants may encourage buyers to focus on new builds in outer suburbs rather than established homes in central locations. Buyers should be aware of these constraints when weighing the role of the first buyers grant in their property plans.

Comparison to Alternatives

The 1st home buyer grant is only one of several government measures aimed at supporting new entrants to the housing market. Alternatives include stamp duty exemptions or concessions, which can save buyers thousands of dollars at settlement. Another option is the First Home Guarantee, a federal program allowing eligible buyers to purchase with a lower deposit without paying lenders mortgage insurance. Each form of support serves a different purpose: while the first home loan grant reduces upfront costs with a cash payment, alternatives like concessions or guarantees target ongoing affordability and deposit challenges.

The Role of First Home Buyer Grants in the Market

First time home buyer grants have played a significant role in helping many Australians step onto the property ladder. However, they are not a one-size-fits-all solution. Grants may make a noticeable difference for some buyers, particularly those purchasing in regional areas or lower-value markets, but have less impact in high-demand metropolitan centres. Policymakers continue to adjust eligibility rules and grant amounts in response to housing affordability trends, which highlights the importance of keeping up to date with the latest information.

Conclusion

Purchasing your first home in Australia often requires careful planning and financial preparation. First time home buyer grants can provide valuable assistance by easing the burden of upfront costs, but they come with conditions and limitations that vary by state and territory. When considering the role of the first buyers grant in your property journey, it is important to view it as one piece of a broader strategy rather than the sole factor in decision-making. By understanding how these grants work and comparing them to other support measures, buyers can make informed choices about the path that best suits their circumstances.

If you are exploring options for purchasing your first home and want clarity on available grants and schemes, the team at Soren Financial can help explain the process and provide guidance tailored to your situation.

FAQs

- What is the first home buyers grant in Australia?

The first home buyers grant is a government payment provided to eligible Australians purchasing or building their first home, with rules differing by state and territory. - Who is eligible for the 1st home loan grant?

Eligibility usually requires applicants to be Australian citizens or permanent residents, over 18, and buying a new or substantially renovated property to live in as their primary residence. - Can first time home buyer grants be used for established homes?

In most cases, grants apply to new builds, but some states allow limited use for established homes, subject to price thresholds and eligibility rules. - How much can I receive from the first time homebuyer grants?

The amount varies by state or territory, typically ranging from a few thousand dollars up to higher amounts for new homes or regional areas. - Are first time home buyer grants the same as stamp duty concessions?

No, they are separate programs. First home buyers may be eligible for both a grant and stamp duty concessions, depending on the state or territory.