From October 2025, Sydney first home buyers can purchase with just a 5% deposit with no salary caps and a new buyer limits and no LMI under the First Home Guarantee. This is a must read for all first home buyers.

Introduction

For years, one of the biggest challenges for first home buyers in Sydney has been saving a large enough deposit. With property prices regularly exceeding the million-dollar mark, pulling together a 20% deposit can feel impossible.

The good news is that the First Home Guarantee (FHBG) is expanding from 1 October 2025, giving more Australians the chance to get into the market sooner with just a 5% deposit and no Lenders Mortgage Insurance (LMI).

But while this is a breakthrough opportunity, it’s important to understand both the advantages and the trade-offs. As mortgage brokers, we’ve run the numbers for a typical $1.25 million property in Sydney to show exactly how this could look for you.

What is the First Home Guarantee?

The First Home Guarantee is a government initiative designed to make home ownership more accessible. Instead of requiring a 20% deposit, the government acts as a guarantor for up to 15% of the loan, so buyers only need to provide a 5% deposit.

Key features of the scheme:

- 5% deposit accepted (instead of 20%).

- No Lenders Mortgage Insurance (LMI), which can save tens of thousands.

- Available for owner-occupied properties only.

What’s Changing in October 2025?

From 1 October 2025, major reforms make the scheme even more attractive:

- No cap on the number of places available.

- No income restrictions for applicants.

- Higher price caps – in Sydney, the cap jumps from $900,000 to $1.5 million.

This means properties priced at $1.25 million will qualify for the first time.

Case Study: Buying at $1.25 Million

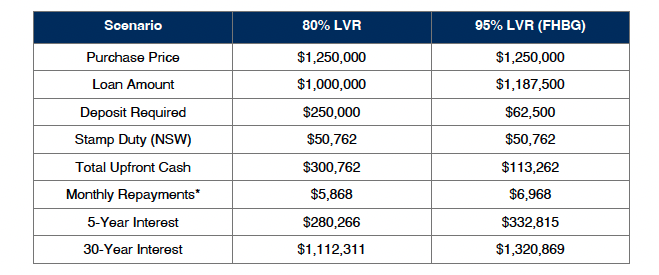

Here’s what the numbers look like when comparing a purchase at $1.25 million with a 20% deposit versus a 5% deposit under the scheme.

Scenario 1: 20% Deposit (80% LVR)

- Purchase price: $1,250,000

- Deposit: $250,000

- Loan: $1,000,000

- Stamp duty (NSW): $50,762

- Total upfront cash required: $300,762

Scenario 2: 5% Deposit with FHBG (95% LVR)

- Purchase price: $1,250,000

- Deposit: $62,500

- Loan: $1,187,500

- Stamp duty (NSW): $50,762

- Total upfront cash required: $113,262

➡️ That’s almost $188,000 less upfront compared to the traditional path.

Repayments and Long-Term Interest

Of course, saving on the deposit doesn’t come without trade-offs. A bigger loan means higher repayments and more interest over time.

At the same rate (5.80% p.a.)

- 80% LVR loan ($1m): $5,868 per month; $280k interest in 5 years; $1.11m over 30 years.

- 95% LVR loan ($1.1875m): $6,968 per month; $333k interest in 5 years; $1.32m over 30 years.

➡️ Extra cost vs 80% LVR: +$1,100/month; +$52k in 5 years; +$208k over the life of the loan.

If high-LVR pricing applies (+0.20% rate loading)

- 95% LVR loan at 6.00%: $7,120 per month; $345k interest in 5 years; $1.38m over 30 years.

➡️ Extra cost vs 80% LVR: +$1,253/month; +$64k in 5 years; +$263k over 30 years.

Stamp Duty Still Applies

One important note: while the FHBG helps with the deposit and avoids LMI, it doesn’t remove stamp duty.

- On a $1.25 million property in NSW, stamp duty is $50,762.

- First Home Buyer Assistance Scheme (FHBAS) concessions do not apply over $1 million.

This means you still need funds for stamp duty in addition to your deposit.

The Upside of the Scheme

- Enter the market years earlier without waiting to save a 20% deposit.

- Avoid paying LMI (which can range from $30k–$70k at this price point).

- Benefit from potential property growth sooner.

The Downsides to Consider

- Larger loan means higher repayments.

- Pay more interest over the lifetime of the loan.

- Still need to cover stamp duty and transaction costs.

Broker’s Insight

“This scheme will be life-changing for many Sydney buyers,” says Mansour Soltani, Director of Soren Financial.

“With just a 5% deposit, you can purchase a $1.25 million property without LMI, freeing up nearly $188,000 compared to the traditional 20% deposit path. The trade-off is higher repayments and more interest, but for many clients, the ability to buy now rather than in five years is worth it.”

FAQs

Q: Do I have to pay LMI under the First Home Guarantee?

No. That’s the key benefit of the scheme — the government guarantees up to 15% of the loan.

Q: Can I use the scheme for an investment property?

No. It’s strictly for first-home, owner-occupied purchases.

Q: Does the scheme reduce stamp duty?

No. You’ll still need to pay NSW transfer duty (around $50,762 on a $1.25m purchase).

Q: Can couples apply together?

Yes. Joint applications are allowed, and from October 2025 there will be no income caps.

Conclusion

From October 2025, first home buyers in Sydney will be able to purchase properties worth up to $1.5 million with just a 5% deposit and no LMI under the expanded First Home Guarantee.

This is an incredible opportunity for those struggling to save the full 20% deposit. But it’s not without trade-offs — higher repayments and long-term interest costs must be considered.

As mortgage brokers, we can help you run the numbers, compare lender offers, and decide whether this scheme is the right move for your situation.

If you’re considering buying under the First Home Guarantee in 2025, book a chat with our team today. We’ll guide you through your options and make sure you’re set up for success.